Credit

decentralized credit intelligence network that provides credit scores

About CREDITO

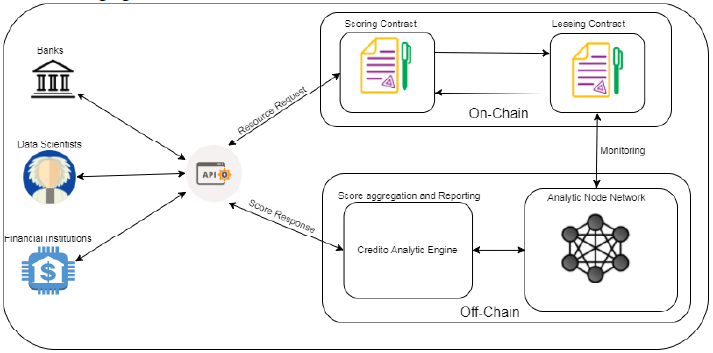

Credito is a decentralized credit analysis network that supports credit scores, transaction costs and credit markets through Ethereal, Intellectual and IPFS contracts, increased transparency and reliability.

The launch of credit markets has been decentralized and provides links between creditors and borrowers living around the world. It removes physical barriers and reduces traditional borrowing and administrative costs. Visit https://credito.io/

CREDITO TOKEN CreDApp consult with CreditO

At that time, mandates were granted to maintain the Creator's risk profile and provide better interest rates for the network. If the creator quickly meets the loan application, he can place an order with interest rates previously reduced.

Token network card

Credits include the ERC20 token, which functions as currency, management mechanism and remuneration system with Credito. Credit will be able to set prices and receive payments for its services in the form of loans - the use of markers. All Creditors must pay royalties on the use of the loan, which will be burned if it can raise the remaining loan demand. The total number of loans burned in each transaction is directly proportional to the decrease in supply.

It also depends on the exchange rate set by the network, which monitor, stock, market conditions and exchange rates at any given time. The fees for lenders and lenders vary depending on the level of the transaction, we estimate the value of 0.5%. All three parties can integrate Credito Analytic Engine or from outside

Credito Network for Banking creates credit risk by identifying future fraud transactions so that the industry can make informed decisions. Although financial institutions are widely recognized as one of the most regulated sectors, they remain fraudulent. The consequences of such fraud are insignificant, leading to financial disasters for banks and customers. Although financial institutions are actively involved in reducing the cost of fraud and fraud, they still lack the real global intelligence of all known fraud and compromises.

According to the Nilson report in 2016, the loss of credit card cheats amounted to 2,015-2,8 billion dollars. The US, which is 162% more than the 2010 figure, reaching up to 8 billion US dollars. UNITED STATES. Losses for 2016 are expected to reach more than $ 24 billion, and losses estimated at $ 31 billion in 2020.

The number of credit and debit card transactions by 2015 is $ 31 trillion. While the total value of credit card transactions grew by almost 7 per cent a year, credit card fraud increased by more than 16 per cent a year.

These losses occur throughout the system, including sales outlets, ATMs and online transactions. While EMV chip technology has reduced the frequency of fraud in the store, it does not help with the fraud of the Internet.

monopoly

Global credit intelligence is under the control of some credit bureaux, and it is often claimed that their item models are outdated, inadequate and non-portable, as it is specific to a country or region. "More than one in five consumers have a potentially significant mistake in their credit history, which puts them at risk, and consumers turn eight million times a year on one of the top three credit bureaus for information on the issue."

security

Hack Equifax has recently revealed 140 million personalities and personal information to hackers and is labeled as the worst security hole in American history.

By 2016, there are more than 15 million victims of identity theft or fraud, while the total $ 16 billion has been stolen.

information Center

Data collected by the central credit bureau. It is a common misconception that this agency automatically exchanges information, which is not true. This entity is a separate company offering similar services at a fee.

Portability

Because credit ratings are not transferable, low risk borrowers may be denied access to credit when they are moved abroad because they are forced to repay their credit rating from scratch.

Outdated analise and incomplete

Information When information becomes more central, monopolistic and incomplete. This leads to informed decisions that are available, which significantly increases the associated risk. In addition, credit scores are not updated in real time, and delays are determined by millions of consumers and businesses because their current credit history is not taken into account in the decision making process.

Credit solutions

As a solution to the above-mentioned issues, we have only created Credito Network or Credito. Decentralized networks based on the Ethereal Block chain, combined with Intellectual Property and Interplanetary File Systems (IPFS), provide a decentralized credit and credit market. Credito promotes the work of a thriving and high quality banking industry that enables financial institutions and digital resource loans to lend people and institutions backward or independent credit systems. The ecosystem provides solutions that enable trusted creditors to provide secure and secure loans to borrowers who are audited.

Credit design principles and values .

Decentralization.

Decentralization is not just the basis of protection against unauthorized access, but also for its infinite. By building a decentralized system, we want to expand conflict-free development within Credito. We believe that decentralization is an important component of a flourishing global long-term ecosystem.

Modularity for simple and flexible systems.

We appreciate the philosophy of developing small tools that work well. Simple components are easy to install and can be reliably integrated into larger systems. We believe that modularity not only allows the modernization system, but also contributes to decentralization.

Safe, transparent and upgradeable.

Credito building for the community. We appreciate the community and will continue to work with data researchers, experts, scientists and security experts to evaluate it. We request official tests, audits and security evidence to create a platform whose reliability and security can support future innovation.

The election contract has two main tasks:

- Response to individual credit account requirements

- Revise terms for third party transaction calculations. In addition, loan balances and utilization rates are monitored.

For certain analysis nodes the leases control the following indicators:

Number of queries specified: Number of requests approved for last node, completed and not executed.

Total number of completed searches: Number of recent searches performed by nodus. On average, it can be based on the number of requests designated to calculate the completion rate.

Average response time: Timeliness of nodal response, which indicates the effect of the node. Average response time is calculated based on completed queries.

Website Reputation: A website's reputation based on previous transactions. All nodes check and print each point, and if most nodes give the same value, the node becomes reliable. This reputation system helps identify and remove the wrong sites of the network.

Credit - Online Credit Report

Loans are the ERC20 tokens used by Credito as the fund management and reward mechanism. Credito will be able to set prices and receive payments for its services in the form of loans.

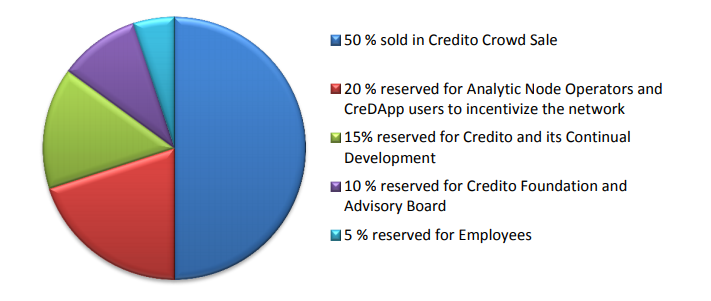

Token Distribution

To continue the development, Credito will offer a one-time sales and sales fee of "TGE", with 50% of the characters available for public sale. The TGE launch date will be announced shortly and will provide a US $ 1 billion loan. As follows:

- Employee distribution has a transition period of twelve months, 25% - every quarter, with 6 months old rock. A proportional allocation to the ownership of each employee on the day the token is sold.

- With the spread of Dana Credito, the transition period is 12 months.

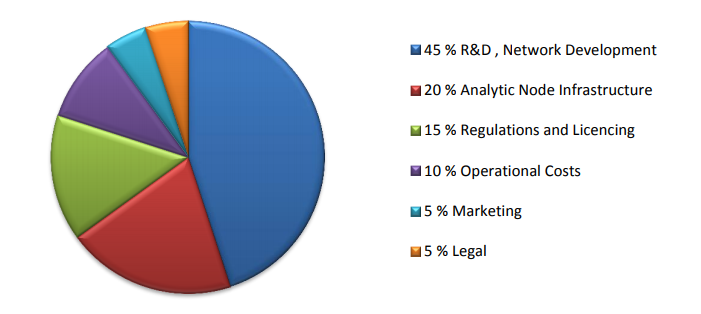

Use of funds provided

Street map

Credito will expand in 6 phases and set important milestones in each phase.

Phase 1 was done

- Concepts and research.

- register credit

- White Paper

- The proof of this concept is a high-speed transaction system.

- Start a website

Registration, verification and partnership in the second phase

- CreDApp interface development

- user registration

- Automatic ID Verification

- Work closely with financial institutions

Infrastructure and Intelligence Development Phase 3

- Development of external APIs.

- Infrastructure of analytical nodes.

- Development of credit development.

- Create a credit score.

- Model Estimated Transactions

Phase 4 Development and Distribution of Intellectual Contracts

- Calculations and leases of intellectual contracts.

- Smart audit examinations

- Integrated smart contract with Credito Analytic Engine and infrastructure node.

- The test network runs.

- Try a trial version, give your partner a direct result.

Phase 5 beginning

- Start that network.

- Decentralized intelligence controls are available for couples.

- External Analysis Node Operator that connects the network.

- Marketing and new partnerships.

The 6th stage protocol of end-to-end loans in major networks

- Develop CreDApp and Mobile App

- Development and audit of Smart Credit Loan Agreement

- CreDApp Brand met Credit Smart Credit Credit Integration

- CreDApp in the test network and the transition to the main network

For more information:

WEBSITE: https: //credito.io/

WHITE PAPER: https: //credito.io/pdf/whitepaper.pdf

FACEBOOK: https://www.facebook.com/CreditoNetwork

TWITTER: https://twitter.com/CreditoNetwork

TELEGRAM: https: //t.me/CreditoCommunity

Username:YosietoQingge

Link: https://bitcointalk.org/index.php?action=profile;u=2303937

Tidak ada komentar:

Posting Komentar